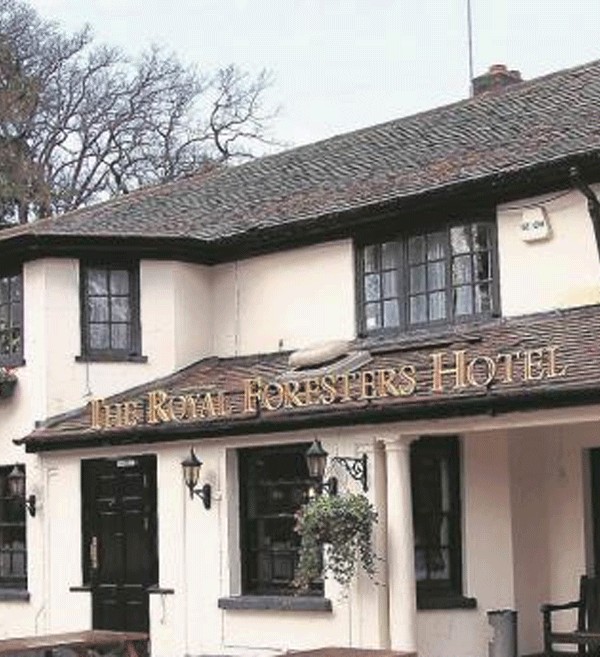

Oakman Property Ltd, the new owner of the historic Royal Foresters pub site in Berkshire, is seeking to raise £2.5 million through crowdfunding platform, Downing Crowd.

Multi-award winning Oakman Inns & Restaurants (“Oakman Inns”), the new management behind the Royal Foresters pub site, is embarking on a total renovation and refurbishment of the existing site into a high-quality pub restaurant with letting rooms, subject to obtaining the necessary planning permissions. Oakman Inns has committed to invest £3.5m in developing the site, subject to planning permission being received.

Downing Crowd already has a strong relationship with Oakman Inns, having previously raised £4.47m through crowdfunding for other sites managed by Oakman Inns, including The Akeman in Tring, Hertfordshire, and more recently a Grade II listed pub restaurant renovation in Olney, Hertfordshire.

Oakman Inns manages an estate of 18 trading pub restaurants located across the Home Counties and Midlands, and in 2017 was voted eighth best company to work for in the UK by the Sunday Times in the mid-size category. The company has a well-established history of creating attractive venues with great service and delicious high quality food and drink, while also engaging with sustainability efforts in the wider local community.

Downing Crowd Bonds are a type of investment-based crowdfunding* that allow investors to lend directly to a wide range of UK businesses via bonds that are secured against a company’s assets. This security seeks to reduce investor risk by enabling Downing, as Security Trustee, the right to sell these assets if the Borrower defaults on the Bond. Investors in this latest £2.5m crowdfunding raise, known as the Royal Foresters Pub Bond, can potentially earn up to 7.5%[1] p.a. interest over a period of up to 18 months. This is a higher interest rate than is typically offered on Crowd Bonds, reflecting the higher risks involved as Royal Foresters is not yet trading. Full details of the bond offer can be viewed at www.downingcrowd.co.uk. The Royal Foresters Pub Bond is also available through Downing Crowd’s newly launched Innovative Finance ISA tax wrapper, which allows investors to earn tax-free interest.

Peter Borg-Neal, Founder and CEO of Oakman Inns and Director of Oakman Property Limited, commented: “It’s a privilege to be able to breathe new life into the historic Royal Foresters site that was once at the heart of the local community. Crowdfunding investors are helping make this a reality and we are excited to be working again with Downing on this latest project. We’ll also focus on creating local jobs along the way and helping with the community’s wider sustainability efforts, highlighted by our top rating from the Sustainable Restaurant Association[2].

Julia Groves, Head of Crowdfunding, Downing Crowd, said: “At Downing Crowd we only invest in established UK businesses, making our Crowd Bonds a great way to see your money make an impact in your local area. Downing already has expertise investing in the UK pub sector, having provided more than £85m funding support for 60 pubs across the UK over the last 15-years. And the wealth of sector experience that Oakman Inns brings to the company really sets this particular business apart.”

“Over a million people have now invested through a crowdfunding platform in the UK[3] but, despite its growing popularity, the different kinds of crowdfunding tend to all get labelled as ‘extremely risky’. In fact, Crowd Bonds are a simple type of securitised investment and, provided investors fully understand the relevant risks compared to savings accounts, they can potentially offer attractive returns in the current climate of low interest rates and rising inflation.”

For more details of the Royal Foresters offer and other Downing Crowd Bonds visit http://www.downing.co.uk/

[1] 7.5% p.a. includes the Early Bird bonus of 0.5%, available until noon on 5 May2017. Oakman Property Ltd also aims to have the pub trading before the maturity date of the Bond which should allow Oakman to refinance at a lower rate of interest and so repay Bondholders, however this is not guaranteed.

[2] In 2016 for 15 out of the 18 sites managed by Oakman Inns.

[3] Source: ‘Pushing Boundaries’: The 2015 UK Alternative Finance Industry Report by Cambridge University and

Nesta, 17 February 2016

NOTES

More about crowdfunding and crowd bonds

Crowdfunding finances projects or businesses by raising contributions from a large number of people, via the internet on a ‘platform’. Crowdfunding contributions can be in return for shares in a company, or to earn interest. Debt-based crowdfunding is usually by way of peer-to-peer (P2P) loans or investing in bonds.

A bond is a simple debt instrument, sometimes referred to as a Fixed Interest Security or a Non-Readily Realisable Security. In order to help manage risk, Downing Crowd Bonds will be secured by a debenture over all the assets of the investee company. This means that if the Borrower defaults on the bond, Downing, as security trustee, has the right to take control of the asset. The proceeds (net of any costs associated with enforcing the security) would then be used to repay some or all of investors’ capital and interest. Bondholders rank ahead of any other existing (or indeed future) loans into the business.

About Downing Crowd

Downing Crowd is part of Downing LLP, an FCA authorised and regulated investment manager with over 20 years of experience, 35,000 investors and in excess of £800 million of funds under management, £200 million of which are in asset-backed businesses.

Downing Crowd was launched in March 2016. The Royal Forester Pub Bond is Downing’s 12th Crowd Bond. As at April 2017, Downing Crowd raised over £22 million on behalf of small UK businesses.

Key risks (please refer to the Offer Document for project specific risks)

Capital is at risk. Bonds are investments, not deposits, and your capital is at risk. Downing will seek to minimise risks but investors should be aware that the returns are not guaranteed and you may not get back the full amount invested.

The Financial Services Compensation Scheme (FSCS) deposit protection scheme does not apply to the Downing Crowd Bonds (please refer to the relevant Offer Document). Under the FSCS investment protection scheme there may be circumstances in which investors can claim up to £50,000 of compensation where Downing LLP is unable or unlikely to honour legally enforceable obligations against it (e.g. claims for fraud or misrepresentation). However, investors will not be able to claim under the FSCS simply because a Bond fails to repay capital or pay interest. This is unlikely to significantly affect the risk of investing in the Downing Crowd Bonds.

Single investment. You are recommended to spread your funds across a number of investments to diversify risk and not to put too much of your capital in one Bond.

Non Readily Realisable. While the Bonds are transferable to other members of the Downing Crowd, there is no formal secondary market in place and you should assume you will need to hold it for the full term.